We have more than 11,000 different assets in the cryptocurrency market right now. Any way you look at it, that’s quite a lot. Out of this large number, just less than 20 of the largest currencies make up 90% of the value of the entire market. This illustrates just how erratic and volatile this market is. Many novice investors make a serious mistake. Following the thinking that if something is more expensive or bigger, it will surely be better, they throw all their investments into one big currency. This investment strategy creates a big risk, because if this one currency goes down a lot, we have no way to limit or compensate for the losses. A very good investment strategy that can prepare us for possible losses is to diversify our cryptocurrency portfolio.

How to properly diversify your cryptocurrency portfolio

What digital assets do we have?

To effectively diversify your currency portfolio, it is important to know and understand the different types of cryptocurrencies and other digital assets between which you will spread your investments.

Stablecoins

Paymant coins

Utility tokens

With the acquisition of a utility token, we gain the right to a product or service of a company. The value of the token should be derived from the utility value of that product/service.

Security tokens

How best to diversify these assets?

There will not be one good answer to this question. Depending on what investment strategy we want to adopt, the distribution of our assets may be different. However, it is important to maintain some degree of diversification. Although there is no one specific answer to the question asked, there are certainly some general guidelines that should be followed:

- Don’t limit yourself to only high-risk assets. It is best to divide the funds in your portfolio so that you have high, medium and low risk currencies.

- To limit possible losses to a certain fixed level, it is worth investing in stablecoins. The investment risk factor of these currencies is low and they allow you to block funds quickly if necessary.

- It is better to be careful about creating large differences in the distribution of different types of assets in your portfolio. That is – even if the value of one of the assets you own suddenly rises sharply, it may be tempting to swap most of the other components of your portfolio for it. However, this can have disastrous consequences. I don’t know if it’s necessary to remind you again, but I will. The cryptocurrency market is very volatile and just as quickly as the value of a currency has risen, it can fall.

- When undertaking both this and any other strategy, it is very important to know the market. You need to watch for new trends. It is also a good idea to use cryptocurrency portfolio trackers, especially if the amount of different funds in our portfolio is large. Cryptocurrency portfolio trackers, are programs or services that allow us to track the movements of available assets in our portfolio. They can relieve us from a lot of data analysis.

Popular cryptocurrency wallet portfolio trackers

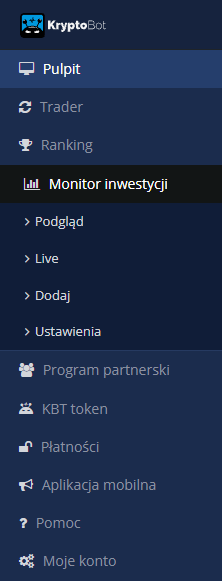

KryptoBot menu

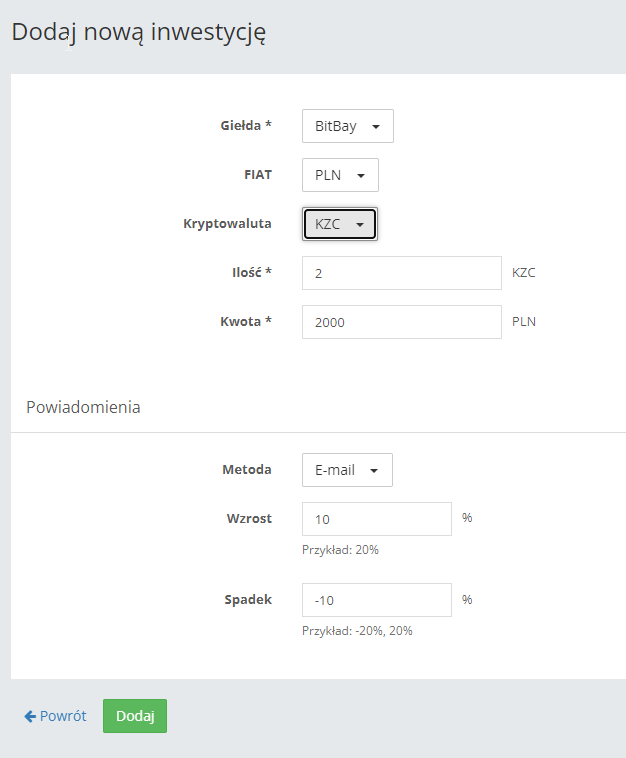

The ‘Add’ tab allows us to make a new investment, and to schedule notifications when a currency reaches a specific rise or fall in value.

Adding the new investment

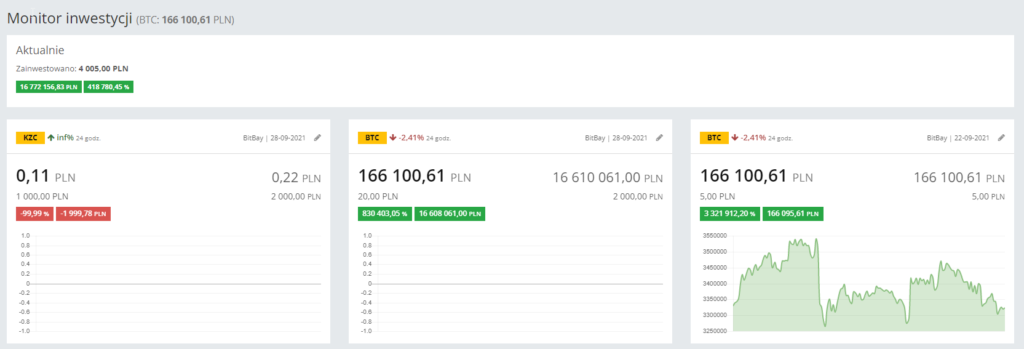

The ‘Preview’ tab shows us the fluctuations in the value of our individual investments.

Investment monitor

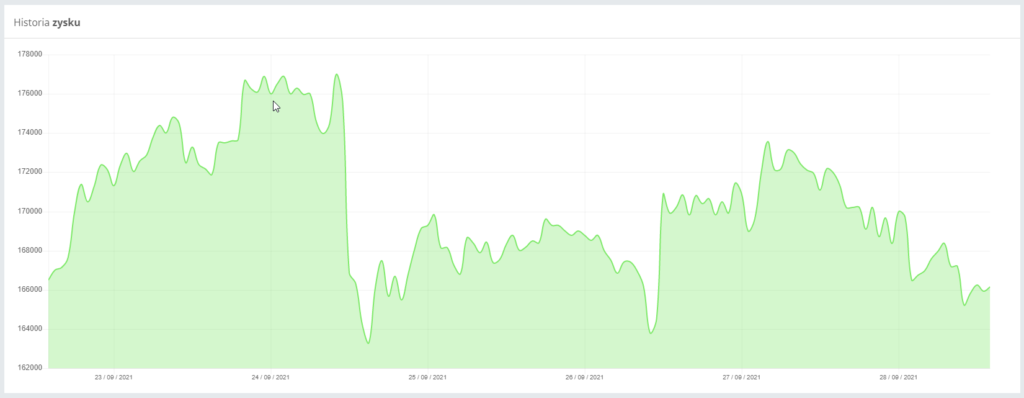

And a profit and loss history that summarizes all of our investments.

Profit history

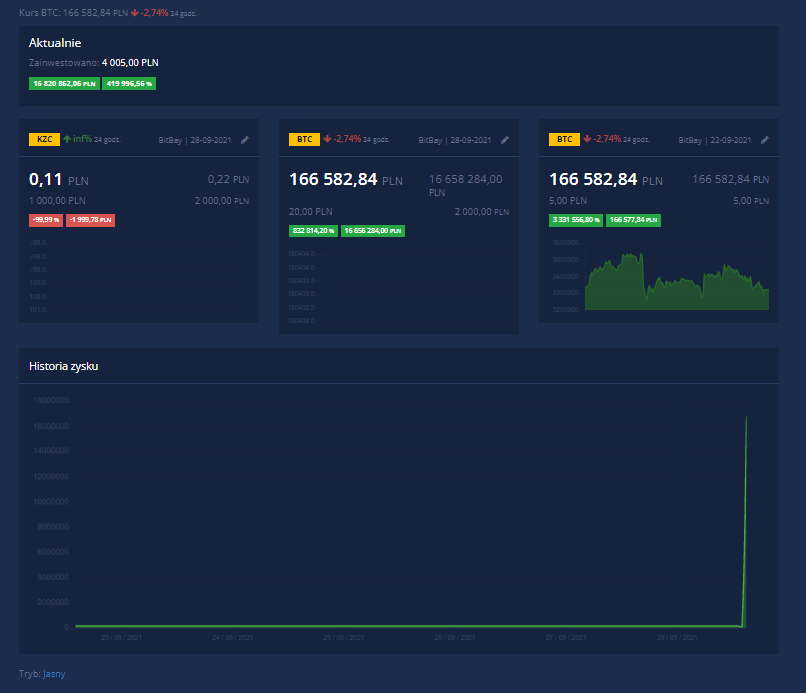

The ‘Live’ tab has very similar functionality to the ‘Preview’ tab with the difference that the data is updated in real time (data is refreshed every 1 minute).

Live preview without login

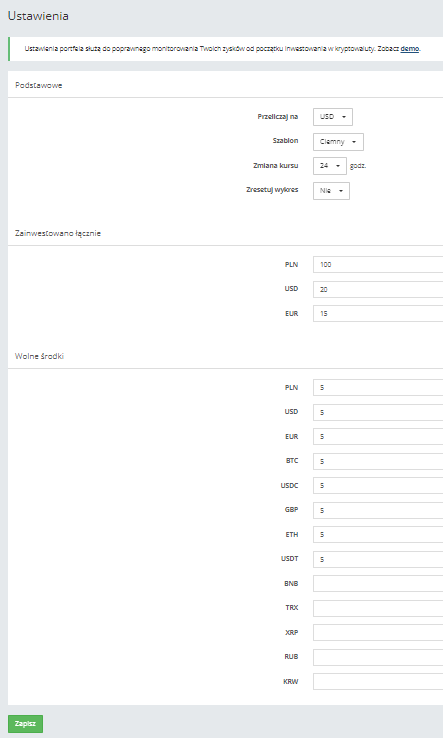

In the last tab ‘Settings’ we can adjust the form in which our data will be presented and complete the information about the history of our investments in cryptocurrencies.

Wallet setting

- https://coinmarketcap.com/

- https://delta.app/en

- https://stonetoss.tumblr.com/post/612212893291888640/big-dump